Executive Remuneration System

Policy on Determining Remuneration for Executives

The Company’s Board of Directors, at its meeting held in March 2021, adopted a policy for determining the details of remuneration for individual directors. The policy was reported to the Board of Directors after a thorough discussion by the Remuneration Committee.

Basic Policy on Determining Remuneration for Executives

Our company positions executive remuneration as an incentive to secure excellent management personnel who contribute to the realization of our Management Principle, enhance awareness of contributing to the company's sustainable growth, and the improvement of corporate value in the medium to long term. Remuneration is determined based on the following policy.

- Level of Remuneration

- We will set remuneration levels that will enable us to secure diverse human resources with the experience and skills necessary to realize global business growth.

- In order to ensure the appropriateness of remuneration levels, we will refer to the remuneration survey data of external research organizations and determine appropriate levels of remuneration with consideration for the Company’s business performance, economic environment and industry trends, etc.

- Structure of Remuneration

- Executive remuneration shall consist of base remuneration, which is a fixed remuneration, and performance-linked remuneration, which reflects company performance and individual evaluations.

- Performance-linked remuneration shall be structured in consideration of the short-term reflection on the Company’s business performance and the medium- to long-term enhancement of corporate value.

- In order to enhance value sharing with shareholders and to increase incentives to increase corporate value from a medium- to longterm perspective, a portion of remuneration will be stock-based remuneration.

- Remuneration for outside directors and directors who are Audit & Supervisory Committee members shall consist only of base remuneration, from the viewpoint of their roles and ensuring their independence.

- Governance of Remuneration

- In deciding the policy for determining remuneration for officers and amounts of remuneration, we place importance on ensuring fairness and transparency, and hold an annual Remuneration Committee meeting with the majority of the committee members being outside directors to make decisions at the Board of Directors based on the reports of the Remuneration Committee.

- To ensure objectivity and transparency, the Board of Directors delegates decisions regarding the amount of individual remuneration for each director to the Remuneration Committee.

- Individual evaluations reflected in performance-linked remuneration are decided by a Nominating Committee meeting with at least half of all committee members consisting of outside directors.

- Both the Remuneration Committee and the Nomination Committee are composed of five members: the chairperson who is an outside director, the Representative Director Chairman and Representative Director President, and three outside directors.

(For information on current committee members, please refer to the "Officers Introduction" page.) - Both the Remuneration Committee and the Nomination Committee report the content of their deliberations and processes to the Audit and Supervisory Committee through their chairpersons, aiming to enhance transparency.

Overview: Remuneration System

- Breakdown of Remuneration

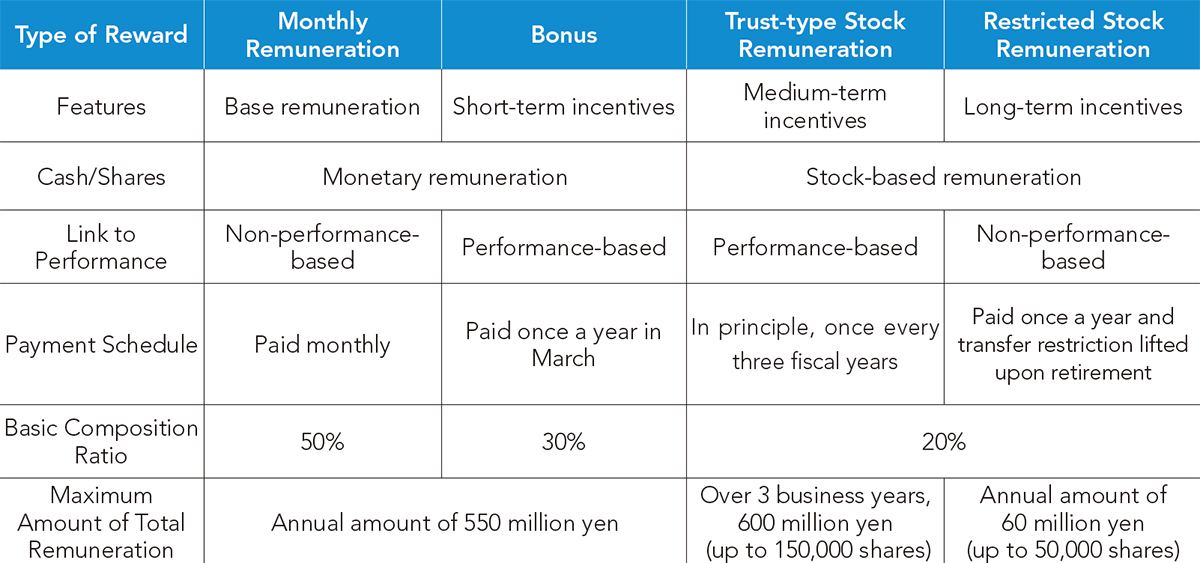

The remuneration for directors (excluding outside directors and directors who are Audit and Supervisory Committee members) consists of a basic salary, which is a "monthly remuneration," a "bonus" as a short-term incentive based on performance for each fiscal year, and a "stock-based remuneration" as a medium- to long-term incentive aimed at sustainable improvement of corporate value. In addition, the structure is basically designed so that the proportions of fixed monetary remuneration (basic remuneration), performance-linked monetary remuneration (bonuses), and non-monetary remuneration such as stock rewards are 5:3:2.

*1. The basic composition ratio of remuneration indicates the basic ratio in the system design, and the ratio shown above fluctuates depending on the state of the Company’s business performance and other factors.

*2. The total limit of monetary remuneration includes the base remuneration for outside directors (excluding directors who are Audit & Supervisory Committee members).

- Performance-based Remuneration

- Bonus

As a form of short-term incentive remuneration, we have adopted profit attributable to owners of parent as an evaluation index, with the aim of raising awareness of contributing to the improvement of business performance in each fiscal year.The amount of remuneration is calculated in the range of 0-200% of the fluctuation range, according to the amount of consolidated net income, and the final determination is made reflecting the results of individual evaluations. - Trust-type stock remuneration

As a form of medium-term incentive remuneration, we have introduced trusttype stock remuneration with the aim of raising awareness of the enhancement of corporate value by achieving the requirements of the management plan, by linking it with the state of achievement of the indicators set forth in the midterm plan set every three fiscal years. The amount of remuneration is calculated within the range of 0-180% of the fluctuation range, according to the state of achievement of the evaluation indicators, and the final determination is made reflecting the results of individual evaluations.

The weights of each item in the Management Plan indicators are uniform (each 25%).

- Bonus

- Non-monetary remuneration

Regarding stock-based remuneration, in addition to the trust-type stock remuneration described above, the Company has introduced restricted stock remuneration with the aim of enhancing incentives to improve corporate value from a long-term perspective. Restricted transferable shares calculated based on the stock price on a predetermined date are allocated in accordance with the amount of restricted transferable share remuneration determined for each position. The transfer restriction is lifted at the time of retirement.

- Restrictions on the payment of stock-based remuneration

In the event of dismissal or resignation of a director during the term of office (except in cases deemed justifiable by the Board of Directors), the Remuneration Committee’s deliberations and reports shall be taken into account, and the payment of stockbased remuneration shall be restricted by resolution of the Board of Directors.

Also, with regard to certain stock-based compensation, if specified requirements are met, the return of stocks granted in the past may be requested. - Approach to holding Company shares

In principle, the Company’s shares granted through stock-based remuneration shall continue to be held for the duration of the director’s term of office. By encouraging employees to hold more than a certain amount of the Company’s shares through the separately established “Guidelines for Shareholding of the Company’s Shares” we are also working to share value with shareholders and raise awareness of the medium to long-term enhancement of corporate value.