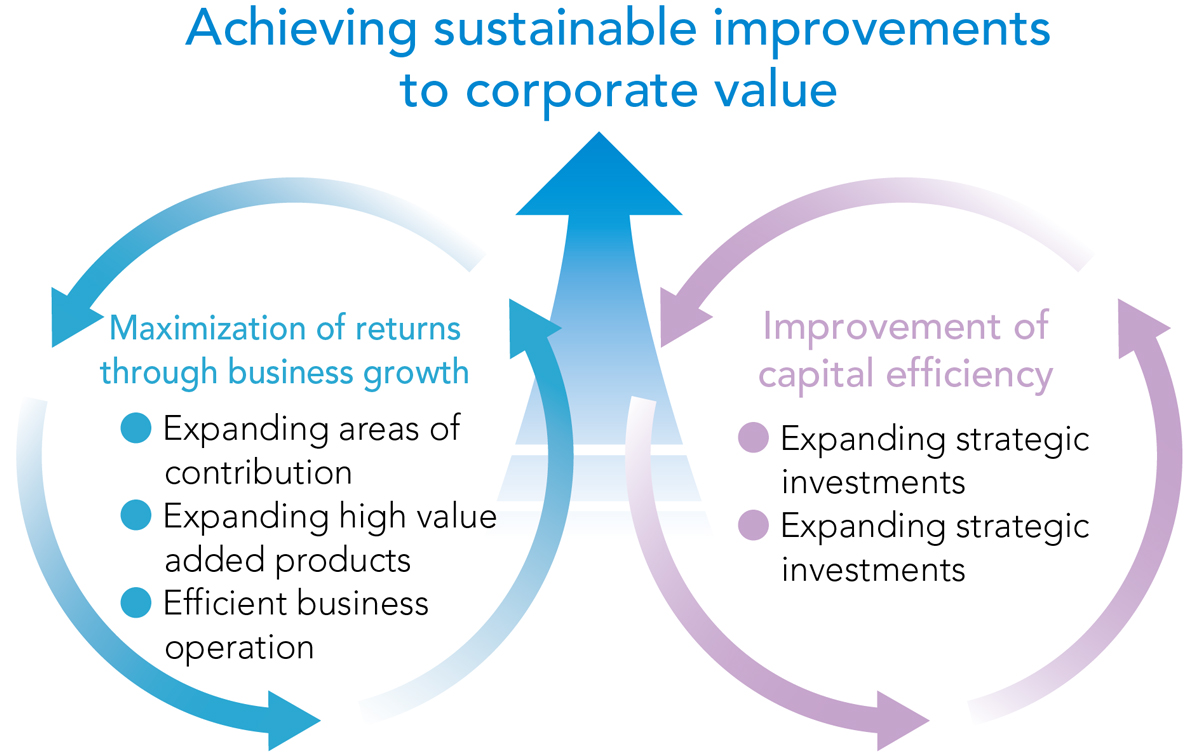

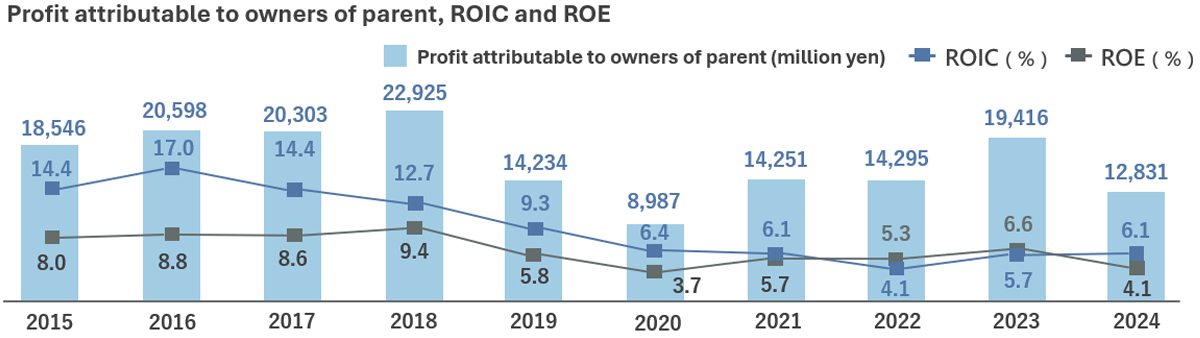

Mabuchi Motor aims to quickly increase ROIC and ROE by maximizing returns through the growth of its business and improving capital efficiency.

As Financial Indicators for Management Plan 2030 Guidance, we have set targets of 300 billion yen in sales, an operating income ratio of 15% or higher, ROIC of 12% or higher, and ROE of 10% or higher, and strive to achieve them.

Action to implement management that is conscious of cost of capital and stock price

Initiatives to Improve Profitability and Capital Efficiency

Initiatives to Improve Capital Efficiency

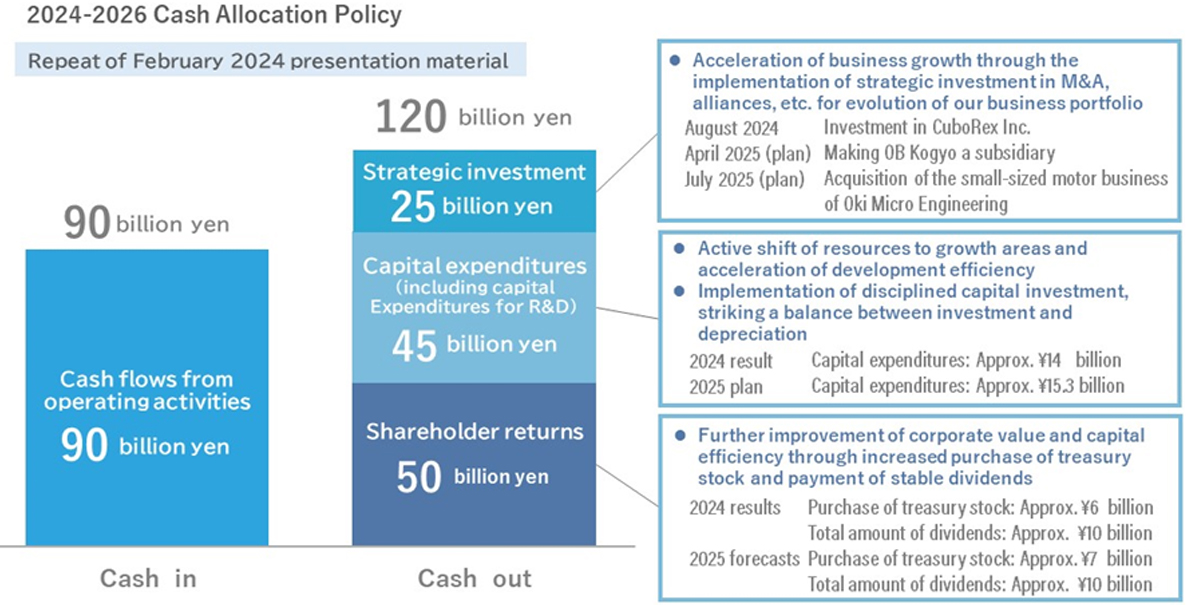

We will actively invest the cash provided by operating activities in growth areas to enhance its corporate value and shareholder return.

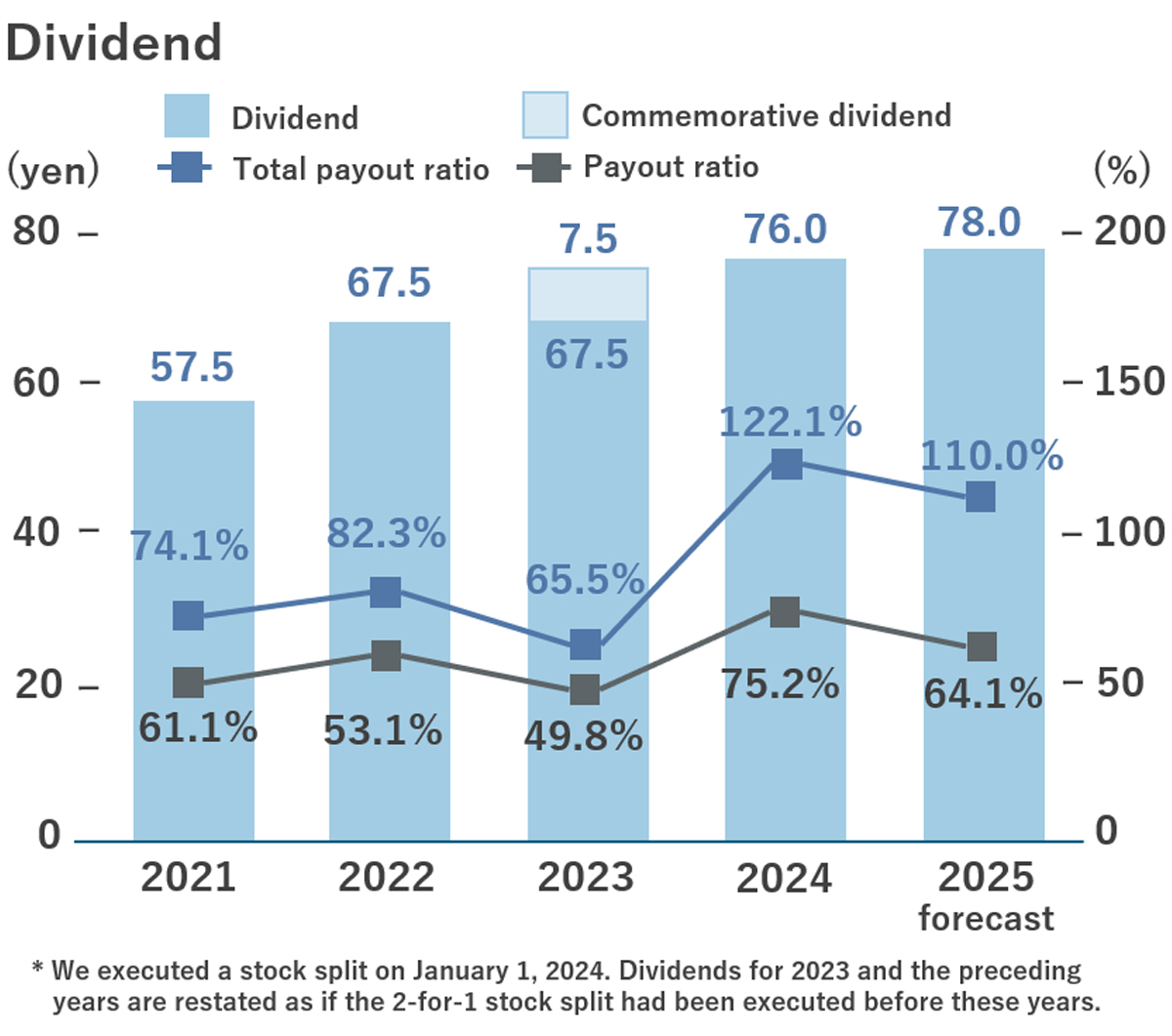

Shareholder returns

In keeping with our basic approach to securing funds and in consideration of the changes in business and market conditions, we will ensure appropriate shareholder return through a flexible and balanced capital policy that includes the purchase of treasury stock.

Dividend policy

Our basic policy is to actively return profits to shareholders in line with the performance of the business while maintaining financial soundness by using retained earnings to fund the research and development and capital investment necessary for the growth and development of the company.

Dividend calculation method

Regarding dividends, the policy is to determine them comprehensively considering cash flow, business environment, and other factors, aiming for a shareholder equity dividend rate (DOE) of 3.0 to 4.0%.

Dividends will be paid based on a DOE of 4%, with an actual ROE of below 10% or an actual PBR of below 1.0 for the previous fiscal year, and If the amount equivalent to DOE of 4% is below the amount equivalent to the dividend payout ratio of 50%, the dividend payout ratio of 50% will be the lower limit, going beyond DOE of 4%.

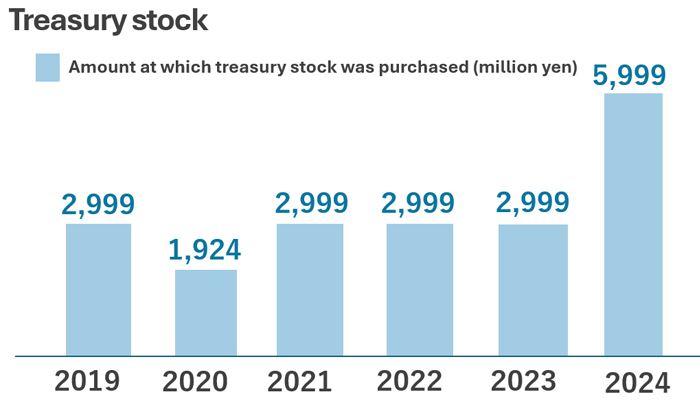

Purchase of treasury stock

We will continue to consider the purchase of treasury stock as appropriate, taking into account PBR and other conditions, in addition to surplus funds and cash flow, to flexibly responds to changes in the stock price and business environment and as a part of our capital policy and a way of returning profits to shareholders.

Expansion of business areas based on the "e-MOTO" business concept

"e-MOTO" is a combination of the English word “electric,” meaning “moved by electricity” and the Latin “moto,” which means “to give motion” and the origin of the word “motor.” Looking towards 2030 we will aim for rapid growth, defining the value we will provide as “motion.” To date, Mabuchi Motor has centered its business around motors as standalone offerings, but in an increasing number of cases customers are demanding the provision of products in complete units, and going forward we will aim to provide solutions that cater to various motions beyond rotation, including control and unit packages. To achieve this, in addition to increasing the types of motors we offer, we will actively utilize M&A activities and collaboration with outside parties as we expand our business domains in areas such as control and units.

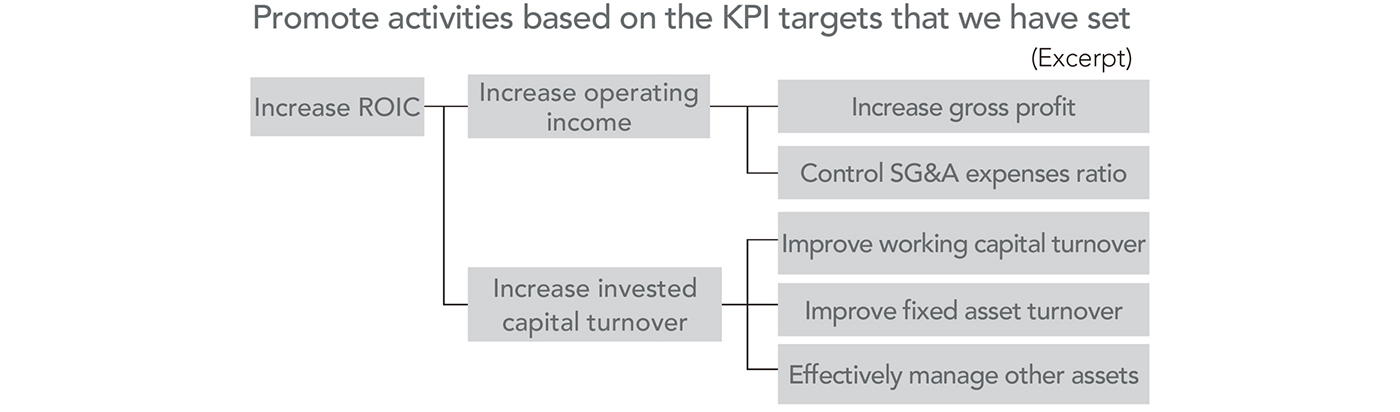

Initiatives to Increase ROIC

We set KPIs that will lead to the improvement of ROIC at each business unit, functional headquarters and site according to their specific tasks for the promotion of activities. We are focusing on systematic activities such as increasing the operating income ratio, reducing inventory and improving working capital turnover. We aim to create a virtuous cycle of monitoring progress quarterly against the KPI targets that we have set, taking specific actions, generating surplus profits, and actively investing in growth areas.

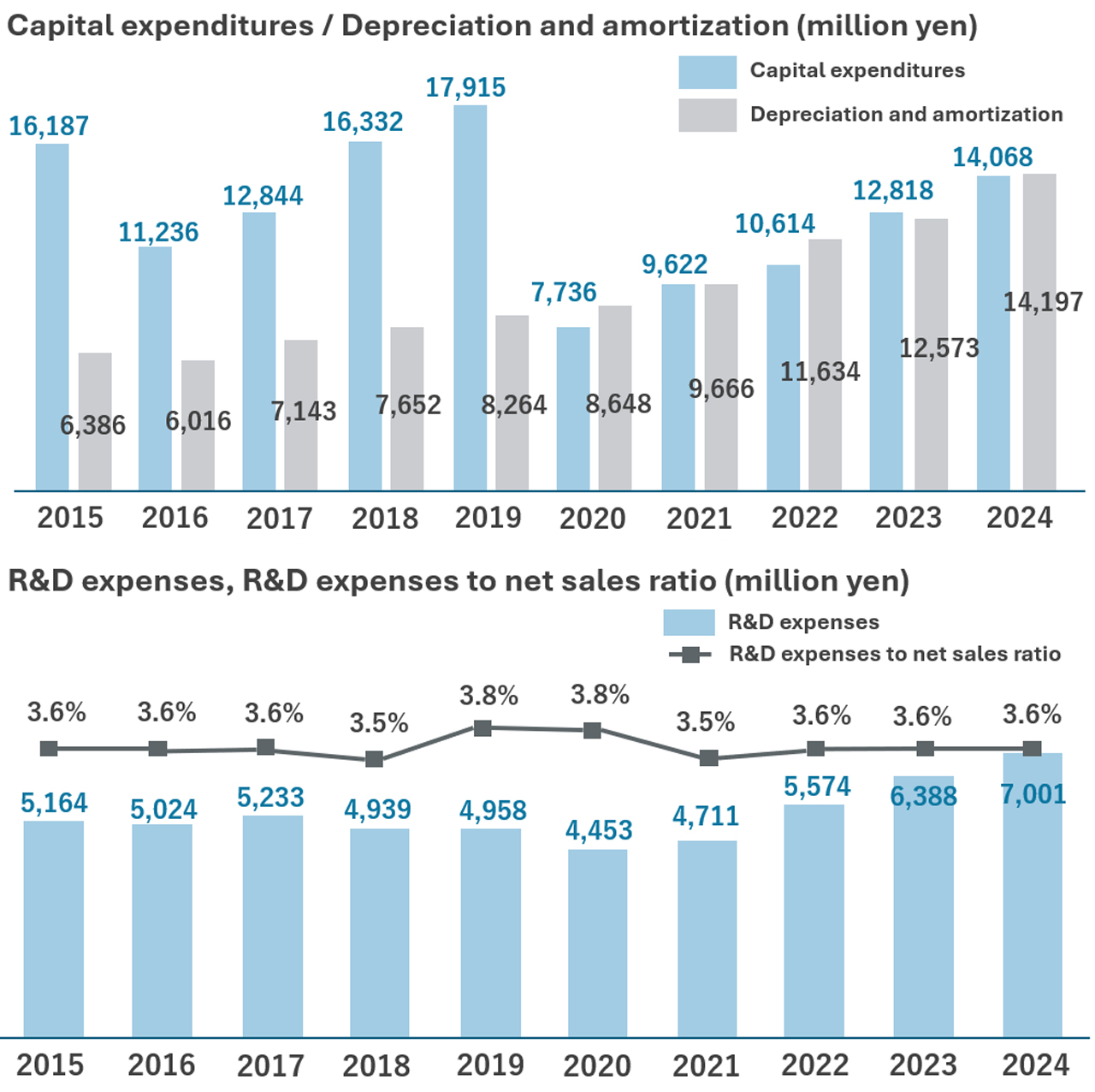

Growth Investment

To practice its Management Principle of “Contributing to International Society and Continuously Increasing Our Contribution,” Mabuchi Motor is proactively conducting R&D, capital investment and M&A activities for future growth. In recent years, we have been investing in the acquisition of land and buildings and production facilities of Mexico Mabuchi and Poland Mabuchi to establish production and supply systems in the Americas and Europe to develop the Five-Region Management Structure, but these investments have peaked out. We will continue to invest in production facilities for new products, increased production, labor reduction and in the field of IT to strengthen our management foundation. Mabuchi Motor is currently aiming to grow in the 3 M fields of Mobility, Machinery and Medical, and is working to develop and launch new high value-added products for new applications. We will also actively promote R&D and M&A activities for the products and technologies needed in these areas.

Initiatives for Improving Profitability

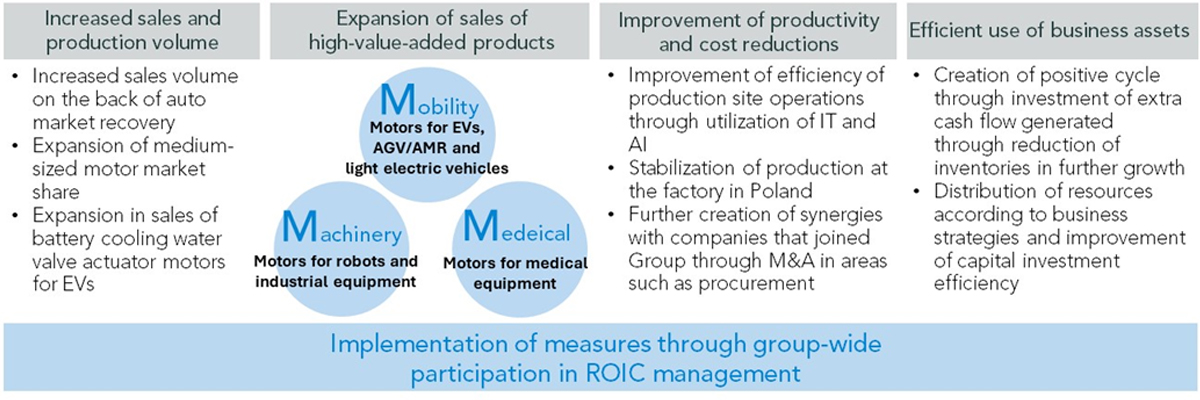

We aim to increase sales and production, with a particular focus on increasing sales of high-valueadded products in the 3 M fields. We will streamline indirect operations at production sites using IT, use AI to accelerate the reduction of labor in inspection operations, and ensure stable production at the factory in Poland as ongoing efforts to improve productivity and reduce costs. Additionally, we plan to increase synergy with companies that have joined the Group through mergers and acquisitions, particularly in the procurement of components and other operations. Another important initiative is the efficient use of business assets. We will create a positive cycle through the investment of surplus cash flow generated through the reduction of inventories in continued growth. We will allocate resources according to our business strategies and improve the efficiency of capital investment.

Approach to Cash Allocation

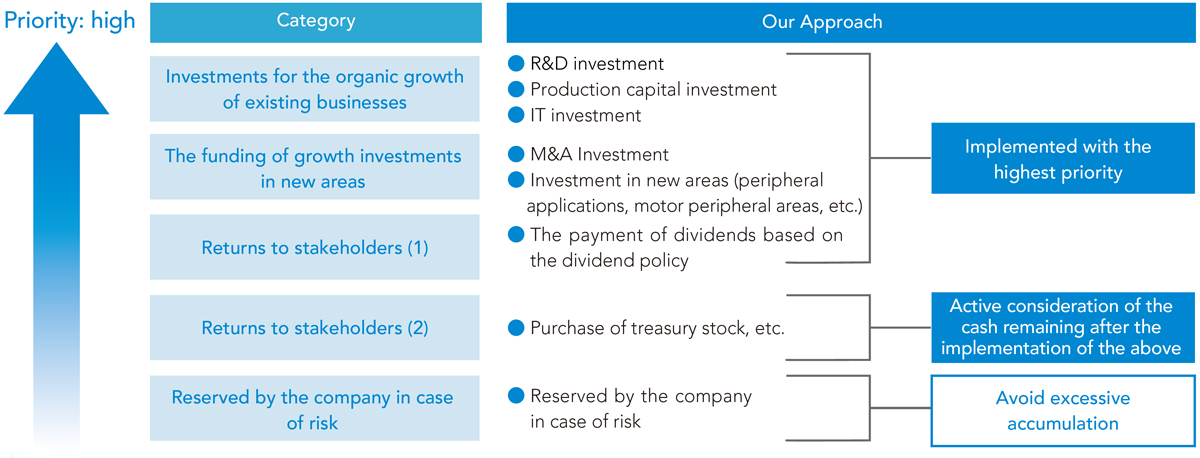

Cash provided by business activities will be used in activities that have been prioritized in the following order. The first priority will be investments for the organic growth of existing businesses and the funding of growth investments in new areas (including M&A investments). The next priority will be funds for the payment of dividends based on our dividend policy.

Regarding the cash remaining after the above, we will consider the portion exceeding the necessary funds as calculated independently as a way to possibly augment shareholder returns (purchase of treasury stock, etc.) without excessively accumulating cash.

Basic Approach to Securing Funds

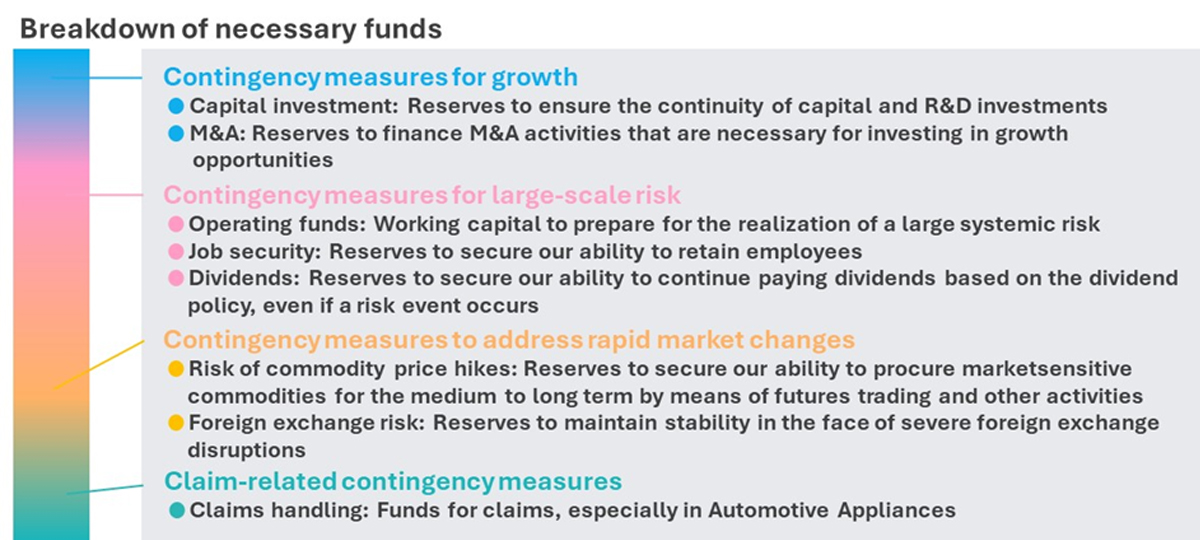

In the short span of around a decade, the world has faced multiple crises, including the pandemic and heightened geopolitical risks, further underscoring the need to be prepared for situations that have the potential to shake the very foundations of corporate management. Moreover, in recent years, it has become essential that we address social issues such as the environmental impact of climate change and the protection of human rights, including in the supply chain. At Mabuchi Motor, always believing that companies are public institutions and must last forever to fulfill their duty to contribute to society, we have set a Long-Term Management Policy, “Continue and expand our contribution to the happiness of all stakeholders.” We have secured the necessary funds and built a solid management foundation to realize this goal. Our approach to this goal is as shown on the below.

Necessary funds

As the size of the business grows, the required funds will increase accordingly, and we always reasonably consider and calculate the funds that will be necessary.